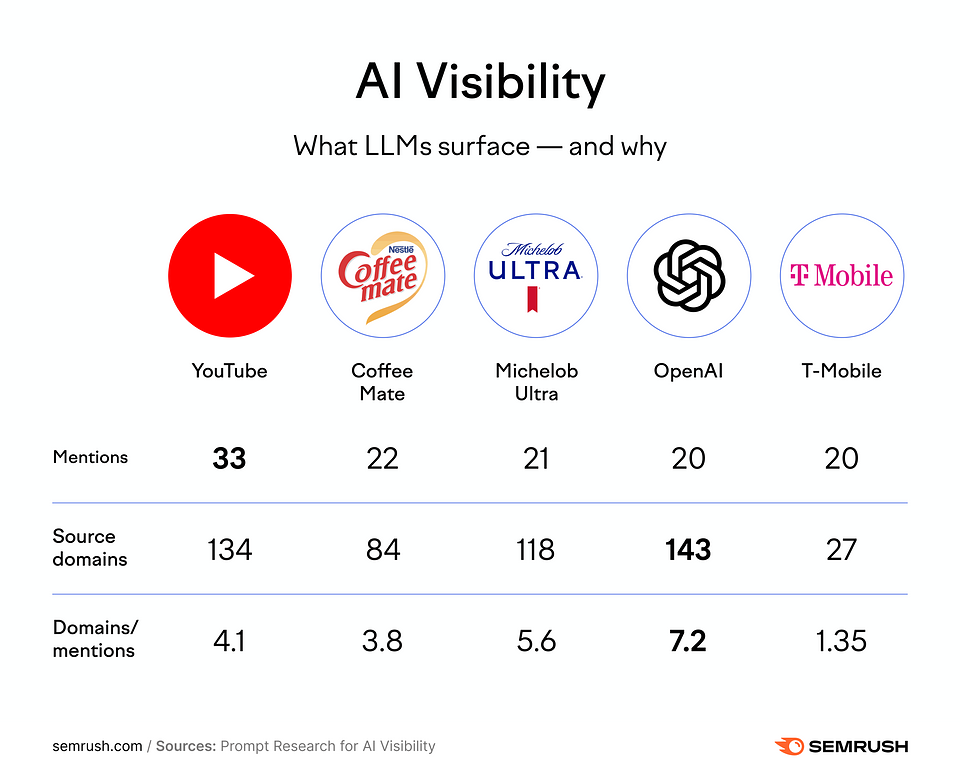

The Brand Visibility Mandate: Why SEO Must Evolve for the AI Discovery Era

The rules of digital visibility are changing fast. As generative AI engines increasingly shape how people discover, evaluate, and choose brands, traditional SEO metrics alone no longer tell the full story. Rankings still matter, but they are no longer the only gateway to...

January 27, 2026